De Minimis Safe Harbor: For Self-Employed, Non-Employees, and Gig Workers!

Let us rejoice in the topic of Tangible Property Expenses: Originally a Reddit Post

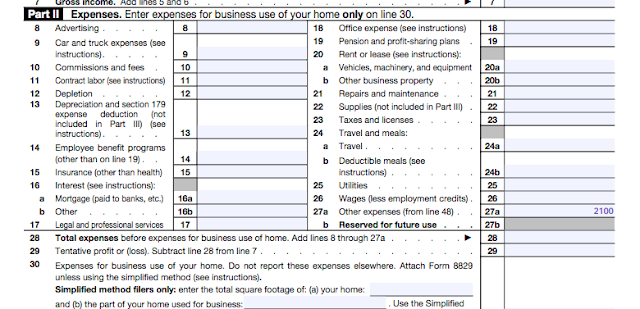

Skip to the end for the link to the website. I'm also going to add some photos from the website on how to fill out the Schedule C form.

Let me start by saying I am not a licensed professional, a mere civilian trying to help out other civilians who don't want to pay for a service that will cost as much as your expected return. A tiny amount but well worth the work to keep it in your pocket. I've had dealings with a 1099-Misc when I should've been considered an employee and I also worked as server for over 10 years, I know a thing or two about taxes and hardship.

Basically, this law--De Minimis Safe Harbor--allows you to claim individual items less than $2,500 (as of 2016, previously was $500) as an expense for one year. These items must be used for business/work purposes only. This allows gig workers or small business owners to claim expense/get returns quicker than using the dreaded depreciation rule every year. You do have to attach a statement to your return claiming that you are using safe harbor, the official statement is listed on the website as well as the IRS website.

Yesterday I was researching this tax laws for hours and I struggled to find a situation close to mine. A lot of articles cater to business owners and not non-employees aka contract workers, and I'm grateful to have found the one I linked below. As you know, this blog is here to save you any extra time I can by doing the research for you. My guess is that the lack of articles out there now are likely due to this being a relatively new law (due to an increase in non-employee/gig workers). Sometimes it's helpful to know situation specifics, read below if that is true for you.

My Situation

I found a side gig monitoring zoom conference sessions, I had just moved and wanted to make a little something on the side while I got something more permanent. Unfortunately, my personal laptop was over 10 years old and I needed it to be able to handle minor video editing. So I inevitably had to purchase a pretty expensive laptop. The job was only a few days a week, so that meant I couldn't claim 100% usage, but I could claim some of it. This is where you need to be careful, only claim the percentage of usage you actually do for WORK. I didn't find any sources saying there was a formula for this, so I took my best guess on how much I actually used my laptop for work.

My best guess was safe, 20% for work, some of you may push the limits but I'm not really a risk taker. Just be smart. In any event, this would mean I would take 20% of the laptop price and write that number down on Part II, Line 27a (Other Expenses) and on the line under Part V - Other Expenses. I felt like I had mastered the art of legal tax evasion, look at me go! 20% of that laptop is basically what I would have paid for a tax professional to tell me to do just that.

I know I'm supposed to be your one stop shop, but do click the links and research on your own if you aren't convinced. The topic you are looking for would be "Tangible Property Expenses". I did try reading related information from the IRS website, but it was a bit difficult to understand some of the language, they also don't really give good examples or provide links to forms for reference while reading. And, it's literally scrolling until you are 100 years old through wordy black text. Confusing on purpose right?

Also, I found out that as of 2020, the IRS passed a law that companies with non-employees have to send a 1099-NEC vs the 1099-Misc, due to the rise in the gig economy that I mentioned earlier. Makes sense looking at the two forms, the misc is way too broad and applies more to entrepreneurs or legitimate contract workers. The latter usually have a significant amount of write offs from large purchases.

Validation from Reddit

Here is the link to the website I referenced above and if you have anything to add, leave a comment!

Schedule C Form Pt. II and Pt. V

|

| See line 27a for where to report expense, remember work usage only. |

|

| Fill out the same information in Part V and describe expense to the left. |

Comments

Post a Comment